Housing Bubble Harms

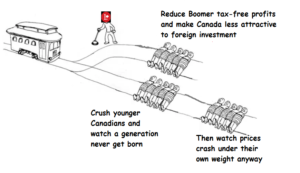

August 27th, 2021 by PotatoAdam Vaughan made himself the face of government callousness and inaction earlier this year[0]. It started with an appearance on TVO’s the Agenda, where when talking about what the government should do about housing, he said “We’re in a safe market for foreign investment but we’re not in a great market for Canadians looking for choices around housing.” Which wasn’t news to a lot of people, but it was news that the government knew and was choosing to do nothing rather than just being incompetent and unaware.

He then continued to say (and followed it up and in various Twitter battles) that the government would not do anything if it meant risking even a 10% decline in house prices — which in the context of the time (over 20%/yr increases, and not just in the big cities) would have been rolling prices back just a few months. But even that was too much for them.

In other words, he said the quiet part loud. And now we all know that they know, and that they don’t care.

He’s tried to make the case that housing prices falling is bad, as have others throughout this decade+ run-up in house prices. People don’t like seeing their biggest asset fall in value, and recent buyers could be underwater and financially stressed. If it gets rolling, it might lead to a recession.

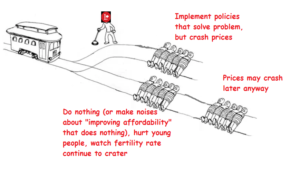

And sure, it’s pretty obvious that if we have a housing crash, it would have many negative effects. The problem is, high prices also have negative effects, and there’s a chance prices will fall anyway in the future, and inaction just delays and exacerbates that.

Why Housing Bubbles are Bad

A housing crash and its associated harms is hard to miss, but the harms of a bubble are more subtle and insidious, but just as bad for society.

Bad? The wealth effect? Our cities becoming “world-class”? These are bad things? Well, those aren’t the only side effects of a housing bubble.

There are much more serious effects on people’s lives. There’s rising inequality, though that’s just part of it.

Housing is the biggest cost in most family’s budgets, and for young people that can be by a huge amount[1]. When housing gets more expensive, they feel the squeeze: literally, if they have to settle for being under-housed to make ends meet. That has real-world consequences.

I can write about the rent-vs-buy decision and raising a kid in a rental all I want, many people out there still want to put off starting families until they can buy sufficient housing for a family. The frenzied speculation makes rentals less secure even if rents themselves have lagged price appreciation. With higher prices (and rapidly rising prices), buying is harder — much harder — and young families have to settle for less space, and delay their purchases to save up. That means they put off having kids longer, and having fewer when they do. Toronto’s fertility rate dropped 16% in the last decade[2]. If anything else had caused our fertility rate to drop that much in just a decade (in the face of millennial demographics that we might have expected an increased fertility rate from) we would be rioting in the streets for the government to do something, holding up signs about the missing 10,000 babies. We’d be banning chemicals, exterminating mosquito vectors, or adding fertility treatments to OHIP coverage. But when it’s economic: crickets. Housing insecurity and microcondos are just the way of life here in a world-class city, and a few thousand unconceived babies are acceptable collateral damage for muh price growth.

Mike Moffat has also pointed out Toronto’s troublesome population movement patterns: the largest cohort of people leaving the city are newborns (followed by other young children and those in the parents of young children age bracket) — so even when a kid is born here, there’s a good chance its family promptly leaves.

Lots of people leaving Toronto and Peel. And who are they? People in the 30s and small children. Why? Priced out of the market. pic.twitter.com/oH8r5oGLhO

— Dr. Mike P. Moffatt (@MikePMoffatt) August 17, 2021

Lower interest rates (that somehow keep going lower) have helped support housing prices: mortgage payments have not increased as much as prices. But they have gone up quite a bit, and even if more and more of that payment goes toward principal, the principal still has to be paid back. 10 years ago, a $775k average detached house required that, at some point, you paid back $775k. Spread evenly over 25 years, that’s $31k/yr. A big chunk of a couple’s after-tax income, but doable if you were pulling in $100-120k combined (and a monthly payment including interest of $3.1k). At $1.7M, that’s $68k/yr to pay it off in 25 years, which doesn’t leave much else for having kids or supporting the economy (and the monthly is up to $5.4k at lower interest rates).

This is a big black hole for the velocity of money: more and more of our salaries are going to paying for our houses. That’s money that isn’t circulating back through the economy, or investing in something productive. Wouldn’t we be better off with lower house prices, and more of our disposable income going to services, innovation, transitioning to a low-carbon economy, charities, etc., instead of having housing sucking up all the cash flow?

In conclusion, while a crash can be harmful, high (and rapidly rising) house prices also have harms. So far the government has made it clear which set of harms they see and care about.

Election Time

A federal election has been called, and more and more people are saying that housing is a big issue for them. Each party has come out with an ineffectual do-nothing housing plan, and not one has acknowledged the elephant in the room: that a solution must allow at least the risk that house prices will drop. The cure to affordability is not to create more loan programs and tax breaks to help people pay higher and higher prices for housing[3] — it’s to get prices lower.

The first step is admitting that there is a problem[4]. I’m a left-leaning voter — often ABC — and while there are a lot of issues I care about (science funding, the environment, electoral reform, etc.), man, at this point I would vote PC if they actually came out with a housing plan that was willing to actually address prices and affordability.

[0] And stealing that crown from DoFo in a pandemic was quite the achievement.

[1] Though for the wealthy who haven’t read my book, investment fees may edge out housing.

[2] And that’s before the effect of the pandemic and lockdowns, which looks to have created its own “baby bust”. Also, other cities did have birth rate declines over the last decade too, though they were lagging Toronto’s — Calgary and Halifax had held steady through to 2016 (which would be about 9 months after Alberta’s oil bust started) and then a step down; London had a small decline in 2016, which was then exacerbated in 2018, while Toronto just heads down and down the whole decade.

[3] which in a tight market just gives people more money to bid which drives prices up further — many of the proposed programs are counter-productive that way.

[4] Update: Rob Carrick had a similar take here (and he got around to hitting publish first while I was dicking around in MS Paint). “Only a major price reversal can restore mass affordability and the federal parties won’t touch policies that would make this happen.”

Questrade: ETFs are free to trade, and if you sign up with my link you'll get $50 cash back (must fund your account with at least $250 within 90 days).

Questrade: ETFs are free to trade, and if you sign up with my link you'll get $50 cash back (must fund your account with at least $250 within 90 days).  Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including sending you an email reminder when new cash arrives and is ready to be invested.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including sending you an email reminder when new cash arrives and is ready to be invested.