Though you wouldn’t think it from the message some housing bulls have. “It’s different here, housing will never go down, the immigrants are coming in waves and buying everything in sight.”

No matter how overpriced the market gets, somehow the magical immigrants will ride down on their rainbow with their pots of gold and buy an investment property or three. Unfortunately, immigrants aren’t going to magically sustain a housing bubble indefinitely. Immigrants are not stupid, and won’t continue buying houses at prices that no one else would touch. Even if they would, there comes a time when there just aren’t enough people with money to keep the whole thing climbing to the moon and it all falls apart.

First off, the “rich overseas investor” is a fairy tale. Ok, yes, there are a few people who come from overseas and buy a house with cash (or “really cheap” unserviced vacant land) and don’t care what interest rates do, but not enough to keep inflating a bubble when all the other buyers face rising rates. Not by a long shot. I don’t have good statistics on the matter, but I wouldn’t be surprised if the wealth and incomes of immigrants is no different than the average Canadian — and if anything, may be lower. Just because a place in Vancouver is still cheaper than one in Hong Kong or London (the Other London) or New York doesn’t mean that people coming from those places will happily cough up Hong Kong prices for Canadian real estate without thinking about it (at least, not forever, and not all of them). Indeed, they’ll probably have Canadian jobs and so the price-to-income measures are every bit as relevant to them.

Secondly, immigrants have never before saved any city from a real estate bubble and collapse. What, you think immigration was invented in 2002? The US has immigration to all its big cities too, and look what happened there. Heck, one of the biggest periods of immigration to Toronto was in the lead-up to the Hong Kong handover in 1997, and real estate crashed big time from the peak in ’89 through the 90’s.

Thirdly, immigrants are not all that different than other Canadians in their desire for housing. So it doesn’t matter whether a person is an immigrant or not — it’s population growth and household formation that drives demand. I’ve actually had people argue that immigration drives housing prices because “immigrants stop at nothing to get a house of their own; they’ll pay any price and live 3 or 4 families/generations to a house until it’s paid off and then buy the next one.” Well, multiple families/generations living under the same roof actually decreases demand (households) for the same number of people, so that argument doesn’t hold a lot of water, it’s just trying to reach for an explanation as to why anyone would pay any price for a house.

For the country as a whole, population growth has been rather steady for a long time now: any increases (real or perceived) in immigration rates are really just offsetting our natural declining birthrate. Now, I don’t have any data on growth rates by city, so it is possible that recently the immigrants have decided to concentrate more on moving to Toronto and Vancouver, though I doubt that it’s actually out of line with any longer-term trends.

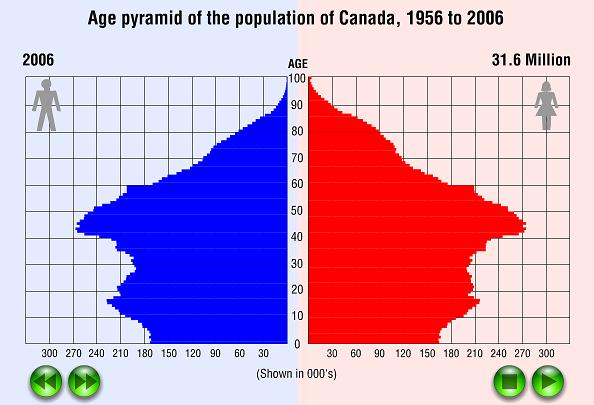

Speaking of household formations though, the one fly in my bear soup comes from this graph (via stats can) of the population pyramid:

The tail-end of the baby boom would have been passing through age 25 right about 1989, which may in part explain the housing boom and crash that happened then. The echo only just started working their way through their homebuying years a few years ago, and won’t be finished for another 5-10 years. I’ve long maintained that the unsustainably high housing prices were due to lax lending, low interest rates, and the madness of crowds. If, however, demographics also play a starring role, then this may take longer to unwind than I thought.

It’s interesting to see how sharp the baby boom was though — the start in ’46 is very sudden, for obvious reasons, but even the tail end sees a 20% decrease in just 3-4 years. The echo isn’t as sudden on either end (though oddly enough, is more pronounced in men than women).

Now, all this isn’t to say that immigration can’t have an effect on a housing market, especially in the short term and when immigration is not smooth — there’s a fundamental limit* to how sharp a baby boom can be, but an influx of new people to an area can happen quite sharply, which can distort a market badly in the short term. Ft. McMurray is a good example of this. As the tar sands projects ramped up there was a huge influx of people to Northern Alberta to work the oil patch. Housing simply couldn’t be built fast enough for the people coming in, and combined with the high wages, the cost of shelter shot up there, to the point where a house in Ft. McMurray was in many cases more expensive than a house in Toronto. But that’s all short-term: as the rate of house construction has a chance to catch up to the demand, then it’s reasonable to expect prices to settle back down to whatever the incomes can support (though in Ft. McMurray those are fairly high), and then down to the cost of building a new house when the builders overshoot the demand.

* – octomoms and bunny rabbits excepted.

Questrade: use QPass 356624159378948

Questrade: use QPass 356624159378948 Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.

Passiv is a tool that can connect to your Questrade account and make it easier to track and rebalance your portfolio, including the ability to make one-click trades.